In 2022, many Colorado families were still financially stretched. Several boosts from earlier in the pandemic ended in 2021, such as stimulus checks and the expanded Child Tax Credit.[1] In our April 2022 survey, families were still not prospering financially.

Forty-four percent of survey respondents found it somewhat or extremely difficult to pay their bills, up from 28% the last time we surveyed families in 2021.[2] Twenty percent of Black respondents and 17% of Latinx respondents faced extreme difficulty paying their bills. Some respondents also used assistance (27%) and free meals (22%) to feed their families. Eighteen percent of families from our survey earned an income below the federal poverty level, or below $27,750 for a family of four.[3]

“Due to the lockdowns…my job was negatively impacted, and we have seen a drastic cut in my overall pay, stressing our family’s finances even further.” – Survey Respondent

Parents who were missing essential child care also saw their work affected. A quarter of parents from our survey were employed but were working fewer hours than they needed to because they could not find or afford child care. Eleven percent of respondents were unemployed. Of those unemployed parents, one-third were unemployed because they had to care for their children.[4]

Many families from our survey used public health insurance programs. Forty-three percent of respondents had at least one household member enrolled in Medicaid or the Children’s Health Insurance Program (CHIP). In our sample, significantly more Black and Latinx respondents (52% each) had at least one household member enrolled, compared to 37% of white respondents.

Some families were struggling to pay bills, were working fewer hours, or were using public health insurance rather than an employer-sponsored plan. The cost of child care also challenged families.

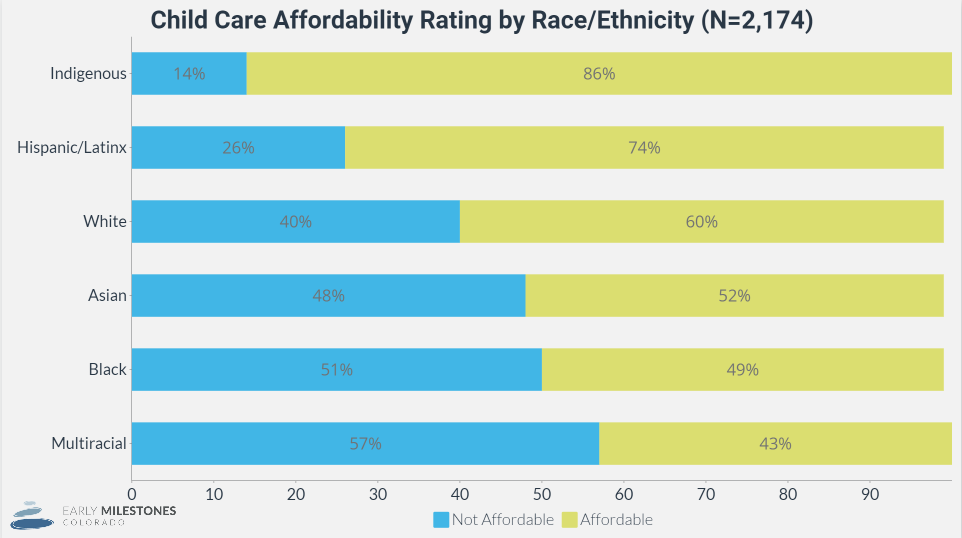

The US Department of Health and Human Services defines child care as affordable when it costs less than 7% of a household’s income.[5] In our survey, families spent an average of 10% of their income on child care. Families who spent more than 7% of their income on child care were twice as likely to consider their child care unaffordable. Overall, 37% of respondents said their child care costs were unaffordable.

“I receive TANF [Temporary Assistance for Needy Families] and CCCAP [Colorado Child Care Assistance Program] – otherwise I would not be able to pay for child care. I am a full-time college student, and the pandemic has greatly affected my education. I live off scholarships that I receive for my education and the pandemic has impacted how much I receive.” – Survey Respondent

One-third of families receiving CCCAP said their child care costs were still unaffordable. Since there was high inflation in 2022, policymakers might consider reducing CCCAP copays.

Targeted supports for basic needs and child care could improve the financial well-being of families, particularly for some marginalized families. In our sample, some Black, Latinx, and Indigenous families had acute financial needs – made worse by child care costs. In a national study, researchers found that families of color were more likely to use the extra monthly income from the expanded Child Tax Credit to pay for child care.[6] Rural families also have acute needs. The Colorado Health Institute found that families in rural, southwest Colorado, and in Pueblo County face some of the most unaffordable child care costs in the state.[7]

Children can only thrive when their basic needs like housing, food, and medical care are met. With child care often being one of a family’s largest expenses, some families struggle to cover these essential costs. Our findings show that reducing child care expenses would lessen financial strain.

FOOTNOTES

[1] https://www.brookings.edu/blog/up-front/2021/01/22/what-is-the-child-tax-credit-and-how-much-of-it-is-refundable/

[2] This finding is consistent with the Census Bureau’s Household Pulse Survey (https://www.census.gov/data-tools/demo/hhp/#/?s_state=00008&measures=EXPENSE&periodSelector=46). When surveyed in early June 2022, 36% of families with children found it difficult to pay for usual household expenses in the last 7 days.

[3] https://www.healthcare.gov/glossary/federal-poverty-level-fpl/

[4] We define unemployed as respondents who wanted to work but did not have work. Respondents who were stay-at-home parents by choice are not categorized as unemployed.

[5] https://www.govinfo.gov/content/pkg/FR-2016-09-30/pdf/2016-22986.pdf

[6] https://www.brookings.edu/wp-content/uploads/2022/04/Child-Tax-Credit-Report-Final_Updated.pdf

[7]https://www.coloradohealthinstitute.org/sites/default/files/file_attachments/CHAS%20Brief%20Child%20Care%20web.pdf